SBA Releases PPP Loan Forgiveness Application (UPDATED*)

Published: May 18, 2020

On Friday May 15, 2020, the Small Business Administration (“SBA”) released the application borrowers will use to request forgiveness of their Paycheck Protection Program (“PPP”) loans. On Friday May 22, 2020, the SBA and Treasury jointly issued an Interim Final Rule clarifying some portions of the forgiveness application. PPP borrowers have been awaiting additional guidance regarding the forgiveness portion of the program for well over a month. While the application and interim final provides some additional guidance, many questions remain.

BACKGROUND

As our readers already know, the PPP loan program was enacted pursuant to the CARES Act as a tool to help small businesses keep employees on their payroll. The draw of the program is the ability for borrowers to have the loans forgiven. In other words, the loans can be essentially converted into tax-free grants. One caveat is that borrowers are permitted to spend PPP loan proceeds on very limited types of expenditures. PPP loans must be spent only on payroll, rent, utilities and interest on certain pre-existing obligations during an eight-week period following loan origination.

SBA had previously required that borrowers certify that 75% of their PPP loans would be expended on payroll. Moreover, subject to one large exception, a portion of loan forgiveness will be lost for borrowers who reduce the number of full-time equivalents on their payroll OR reduce the average hourly wage or annual salary of an employee by more than 25%. The aforementioned exception to loan forgiveness applies where (i) reductions in full-time equivalents or average hourly wages and salaries took place between February 15 and April 26, 2020 and (ii) the number of full-time equivalents and compensation are restored by June 30, 2020 (the “June 30 Restoration Exception”)

THE APPLICATION

As noted above, many questions remain unanswered but the application does provide clarification of certain issues, including the following.

Eight Week Testing Period / Covered Period

In order to qualify for forgiveness, amounts must be spent during the eight-week period commencing upon the date the loan proceeds are disbursed to the borrower (the “Covered Period”). For administrative convenience, borrowers who pay employees at least as often as biweekly may elect to calculate eligible payroll costs using the eight-week period that begins on the first day of their first pay period following the loan disbursement date (the “Alternative Payroll Covered Period”). Note that this alternative eight-week period only applies to payroll costs and not to other qualifying expenditures.

Expenses Paid or Incurred

One question that tormented borrowers was whether eligible costs had to be paid and incurred during the Covered Period or whether they could be incurred and/or paid during the period. With respect to payroll costs, the application provides:

Borrowers are generally eligible for forgiveness for the payroll costs paid and payroll costs incurred during the eight-week (56-day) Covered Period (or Alternative Payroll Covered Period) (“payroll costs”). Payroll costs are considered paid on the day that paychecks are distributed or the Borrower originates an ACH credit transaction. Payroll costs are considered incurred on the day that the employee’s pay is earned. Payroll costs incurred but not paid during the Borrower’s last pay period of the Covered Period (or Alternative Payroll Covered Period) are eligible for forgiveness if paid on or before the next regular payroll date. Otherwise, payroll costs must be paid during the Covered Period (or Alternative Payroll Covered Period).

Similarly, with respect to eligible non-payroll costs, the application provides:

An eligible nonpayroll cost must be paid during the Covered Period or incurred during the Covered Period and paid on or before the next regular billing date, even if the billing date is after the Covered Period.

However, the May 22 Interim Final Rule clarifies that pre-payments of interest are not eligible for forgiveness. Accordingly, it appears that any eligible payroll or non-payroll costs (other than prepayments of interest) paid during the Covered Period count towards loan forgiveness despite when the cost was incurred. Additionally, costs incurred during the Covered Period and paid in accordance with the usual schedule for payment can also be forgiven even if the payment date falls after the conclusion of the Covered Period.

Calculating Full-Time Equivalents

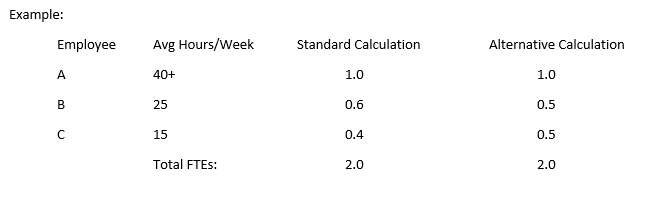

Recall that a reduction in full-time equivalents (“FTEs”) during the Covered Period will result in a proportionate reduction in loan forgiveness. The application permits borrowers to calculate the number of FTEs in one of two manners. The first way to calculate FTEs is to determine the average number of hours worked by each employee per week during the Covered Period and divide that number by 40. The resulting quotient is rounded to the nearest 1/10th and capped at 1.0. Alternatively, borrowers can count all employees who average 40 or more hours per week as 1.0 and each employee working less than 40 hours as 0.5. Once the borrower has calculated each employee’s FTE status, the results are aggregated.

The average number of FTEs during the Covered Period is then compared against the number of FTEs during one of the following periods (at the Borrower’s election): (i) February 15, 2019 to June 30, 2019; (ii) January 1, 2020 to February 29, 2020; or (iii) in the case of seasonal employers, a consecutive twelve-week period between May 1, 2019 and September 15, 2019. The number of FTEs for the Covered Period and the number of FTEs during the reference period chosen by the borrower must be calculated using the same methodology.

Additionally, any FTE reductions resulting from one of the following reasons will not impact loan forgiveness: (i) employees who were terminated prior to April 26, 2020 and who rejected a good-faith, written offer of rehire during the Covered Period (the employee’s rejection of the offer to rehire must be reported to state unemployment insurance offices); and (ii) any employees who (a) were fired for cause, (b) voluntarily resigned, or (c) voluntarily requested and received a reduction of their hours.

Calculating Salary and Wage Reductions

As noted above, borrowers who reduce their employees’ salaries by more than 25% will suffer a loss in the amount of loan forgiveness. This calculation is made on a per employee basis. Meaning, each employee’s compensation during the Covered Period is measured against that employee’s compensation from January 1, 2020 to March 31, 2020.

It is unclear how this rule would apply if the borrower terminated a number of employees and rehired lower wage workers.

June 30 Restoration Exception

Any reductions in FTEs or compensation that are restored on or before June 30, 2020 will not result in a reduction of loan forgiveness. The application does not specify how this rule operates. For example, for how long do employees need to be rehired? How does one test FTEs on June 30, 2020? Is it a one-day test or do we test based upon a payroll period ending or starting on June 30, 2020?

Owner Compensation

Pursuant to prior SBA guidance, compensation payable to owners is limited to 8/52 weeks of 2019 net profits. Additionally, healthcare expenses and retirement contributions attributable to self-employed individuals, general partners and other Schedule C filers are not eligible for forgiveness. It appears that health and retirement contributions made on behalf of shareholder-employees are eligible for forgiveness.

The application requires a certification that the amount for which forgiveness is requested “does not exceed eight weeks’ worth of 2019 compensation for any owner-employee or self-employed individual/general partner, capped at $15,384 per individual.” Accordingly, it appears that borrowers cannot receive full loan forgiveness if they use PPP funds to increase compensation to owner-employees, including corporate shareholder-employees.

Loan Forgiveness Process

In order to receive loan forgiveness, borrowers must submit the PPP loan forgiveness application linked in the introductory paragraph above to its lender. Within 60 days of receiving the application, the lender must issue a decision to SBA regarding loan forgiveness. Within 90 days of receiving the lender’s decision and subject to the SBA’s additional review of the original loan and/or forgiveness application, the SBA will remit payment of the appropriate forgiveness amount to the lender together with accrued interest on such amount. Accordingly, it can take up to 150 days to receive final notification of loan forgiveness.

CONCLUSION

While these new rules do provide some additional guidance, the answers to many important questions (particularly with regard to the June 30 Restoration Exception) still remain unclear.

Some practitioners expect that SBA will promulgate further guidance concerning PPP loan forgiveness. However, it is unlikely that such guidance will be issued soon enough to be helpful for borrowers who have already received loans. Additionally, there are many proposals being discussed in Congress to amend the Paycheck Protection Program. We will be sure to provide additional updates in the event additional guidance is issued or amendments are enacted.

*This alert was initially published on May 18, 2020 following the release of the PPP loan forgiveness application and has been updated to include certain clarifications provided by the May 22, 2020 Interim Final Rule.

NOTE: This article has been updated from the original publication on May 18, 2020 to reflect new information provided by the SBA on May 22, 2020.